An Alternative

approach to Investment

about

Altus Investment Management Limited, established in 2003, is a London based, FCA

regulated investment management firm that provides advice to individuals, families

and foundations

Our independence and extensive network have provided access to the best

investment ideas and delivered exceptional performance to clients. We have an unconstrained

approach to asset allocation with a specialist expertise in alternative investments.

We provide our clients with highly customised advice allowing them to

diversify their portfolios based on their needs and goals.

Relationships are built on trust and transparency, offering a service

more tailored and responsive than that offered by large institutions.

We have an enviable track record of protecting clients’ wealth and

providing thoughtful, innovative and timely investment solutions

to help our clients achieve their goals.

solutions

Portfolios are built and managed so that they are diversified by style, asset class and regional exposure.

We have 3 key target drivers:

01

Outperformance

We manage client portfolios with a market agnostic approach that delivers returns on an absolute basis throughout the market cycle.

02

Downside protection

Returns have historically been more robust to thematic shifts and fat-tail type shocks – which acts as a good diversifying allocation for a wider portfolio.

03

Factor exposure & alpha

We focus carefully on the diversification of risks and the correlation of returns.Our returns are not derived from or dependent on traditional factors.The majority of our portfolio’s returns are ‘residual’ or in other words independent from these factors.

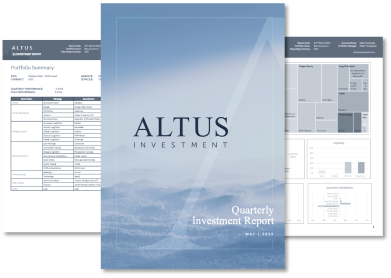

Bespoke & Transparent Reporting

We understand that clients often have complex financial objectives and unique individual circumstances.

We tailor our services to ensure that we meet each client’s requirements, fulfilling a variety of roles from trusted advisor across their entire wealth, to standalone Investment Manager for specific niche mandates.

We are set up to be flexible and responsive in thinking, operational support and execution. We provide detailed performance reporting to our clients.

We understand that trust is earned through communication over time. We are fully transparent and encourage open dialogue to ensure that our clients are comfortable that we are fulfilling their needs.

Team

A depth & breadth of alternatives experience

Andrew Trower

Executive Chairman

Read Bio

Peter Thompson

Chief Investment Officer

Read Bio

James Trower

Chief Operating Officer

Read Bio

Thomas Crick

Portfolio Manager

Read Bio

Lee Cory

Head of Real Estate

Read Bio

Maria Cruceru

Operations Administrator

Patrick Egan

Head of Compliance

Read Bio

Sarla Bhavnani

Compliance Manager

Emilia Stefanczyk

Office Manager

Insights

Alternative Thinking